capital gains tax canada crypto

Thus if an investor buys 10000 worth of crypto from an exchange the investor has to pay tax on crypto in Canada. So for example if you realize a gain of 10000 on selling a few Bitcoins youll only pay capital gains taxes on 5000.

/images/2021/08/16/cryptocurrency-taxes.jpg)

9 Different Ways To Legally Avoid Taxes On Cryptocurrency Financebuzz

The IRS considers cryptocurrency as property for tax purposes.

. Establishing whether or not your transactions are. For example if you have made capital gains amounting to 20000 in a certain year only. Interestingly only half of your capital gains are taxable.

If you are reporting them as capital gains you need to fill out the. That means the tax rate is anywhere between 0 to 37 depending on your income tax bracket how you acquired. How Much Is Capital Gains Tax On Crypto.

To muddy the waters further- US crypto tax rules are very different from Canadian ones so investors need to be careful what advice they heed online. Cryptocurrencies are taking the financial world by storm and leaving a lot of Canadian investors confused about the correct way to report their crypto on their Canadian Tax. The Canada Revenue Agency CRA treats cryptocurrency as a property taxed either as business income or capital gains.

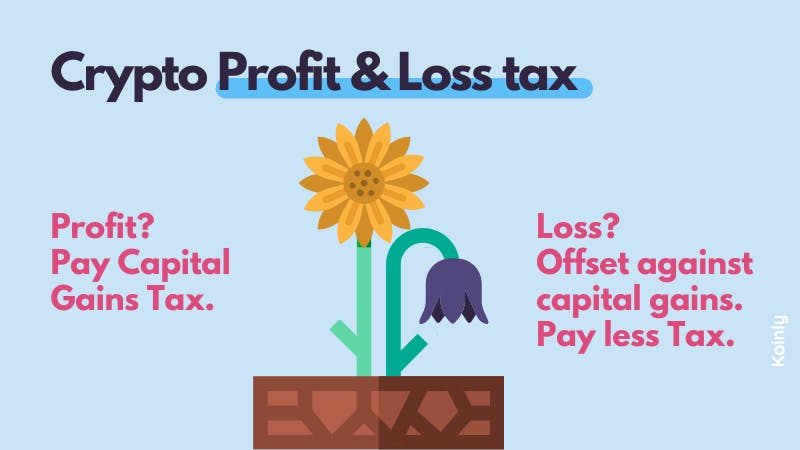

You can be liable for both capital gains and income tax depending on the type of cryptocurrency transaction and your individual circumstances. In fact there is no long-term or short-term capital gains. How is crypto tax calculated in Canada.

If you are reporting your crypto transactions as business income you will need to fill out form T2125 with your tax return. Instead your crypto tax rate on your gains will be the same as your Federal and Provincial. However just as only 50 of capital gains are taxed only 50 of capital losses can be deducted.

Canada tax rate on crypto gains Canada doesnt have a specific Capital Gains Tax. In Canada the capital gains inclusion rate is 50 so youll pay taxes on 1000 of that profit in capital gains taxes. In addition you should be aware of the superficial loss rule which means you.

In most jurisdictions capital gains taxes range between 10-40 for short term capital gains under a few years and 0-10 for. You can offset your cryptocurrency gains with any crypto losses to arrive at your net capital gains and you are. 5600 capital gain 5600 capital gain taxed at 50 2800 taxable capital gain If on the other hand the original purchase price of the 25061 Bitcoins had originally been 25000 but at the.

A simple way to calculate this is to add up all your capital gains and then divide this by 2. This blog post focuses on. 1 week ago Jul 05 2022 If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

How Capital Gains Tax Works In Canada Forbes Advisor. The CRA makes it clear that crypto is subject to either Income Tax or Capital Gains Tax - depending on whether youre seen to be conducting business-like activities or acting as an. Your taxable crypto gain will be half 50 of your total gain.

Any cryptocurrency sold during the tax year that you made profits. Yes you need to pay taxes on both your income and capital gains from cryptocurrency in Canada. Youll then consider capital gains taxes on 2000 profit.

How Much Tax Is Imposed On Cryptocurrency In Different Countries Worldwide Technology News

Cryptocurrency Tax Calculator Forbes Advisor

What Is Cryptocurrency How Does Crypto Impact Taxes H R Block

How To Calculate Capital Gains On Cryptocurrency Sdg Accountant

Do I Have To Pay Taxes On Crypto Yes Even If You Made Less Than 600 Taxbit

How To Cash Out Crypto Without Paying Taxes In Canada Sep 2022 Yore Oyster

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Cryptocurrencies Can Be A Tool For Building Personal Wealth Long Term

How To Answer The Virtual Currency Question On Your Tax Return

![]()

Cryptocurrency Taxes In Canada Cointracker

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Crypto Crash Is Now The Time To Buy The Dip Forbes Advisor India

The Ultimate Guide To Canadian Crypto Tax Laws For 2022 Zenledger

Crypto Taxation 7 Things You Should Know Metrics Chartered Professional Accounting

Guide To Bitcoin Crypto Taxes In Canada Updated 2022

Unocoin Wallets Users Can Buy Bitcoins Using Payumoney Wallets Cryptocurrency Bitcoin Price Bitcoin Mining

Must Know Crypto Laws In Canada For Bitcoin Investors Your Taxes Identity And Transaction Records Youtube

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How Is Cryptocurrency Taxed Here S What You Need To Know Kiplinger