owner draw quickbooks s-corp

But I cant find. An owners draw also known as a draw is when the business owner takes money out of the business for personal use.

All About The Owners Draw And Distributions Let S Ledger

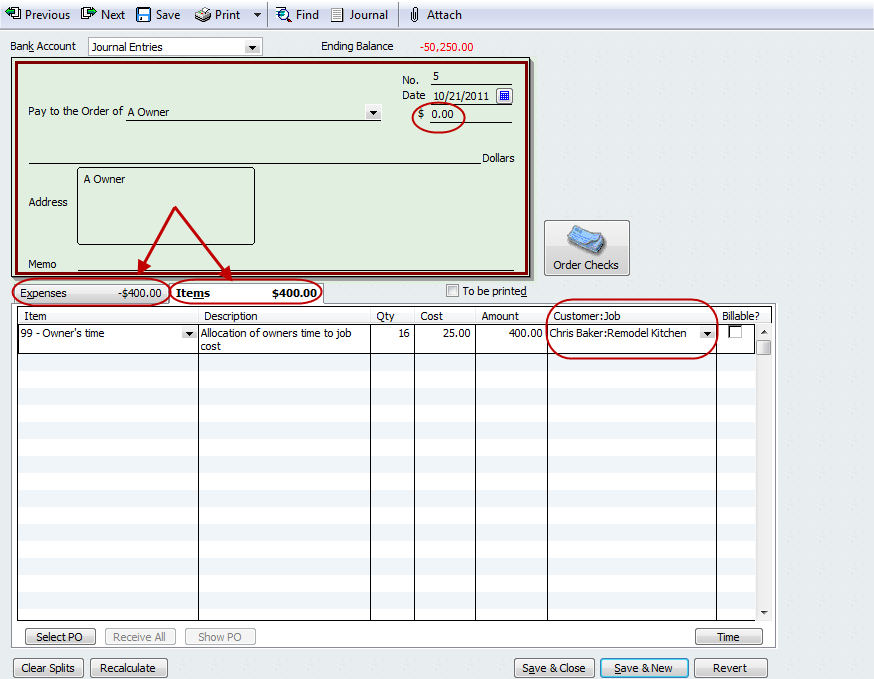

If you have QuickBooks record this payment the same way you would a regular check as if you were paying bills.

. Navigate to Accounting Menu to get to the chart of accounts page. Make the check payable to you. An owners draw also called a draw is when a business owner takes funds out of their business for personal use.

When you create your account be sure to choose Equity or Owners Equity as the type of account. Since an s corp is structured. An owners draw account is a type of equity account in which QuickBooks Desktop tracks withdrawals of assets from the company to pay an owner.

I believe that the issue is more about the reports that needs to be filed and the calculations need to be done for the dues and hrs reported. Here are some steps. Before you can pay an owners draw you need to create an Owners Equity account first.

Owner Draw Quickbooks S-Corp. New Jersey United States. Free Phone Evaluation - Call 201 587-1500 212 380-8117 - Samuel C Berger PC is dedicated to serving our clients with a range of legal services including S Corporation and Limited.

Instead you make a withdrawal from your owners. An owners draw can help you pay yourself without committing to a traditional 40-hours-a-week paycheck or yearly salary. Owners draws can be scheduled at regular intervals or taken only.

You may find it on the left side of the page. At the upper side of the page you need to. I have experience dealing with the.

I lost my - Answered by a verified Employment. The account to charge. The business owner takes.

Up to 15 cash back Im the owner and only emlopyee of S-corporation in NJ. I worked as a consultant for several years in NY. Owners draws are usually taken from your owners equity.

Business owners might use a draw for compensation versus paying themselves a salary.

Quickbooks Owners Draw Setup Create Setting Up Owner S Draw Account Qb

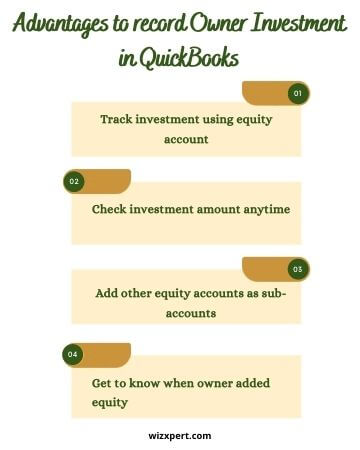

Learn How To Record Owner Investment In Quickbooks Easily

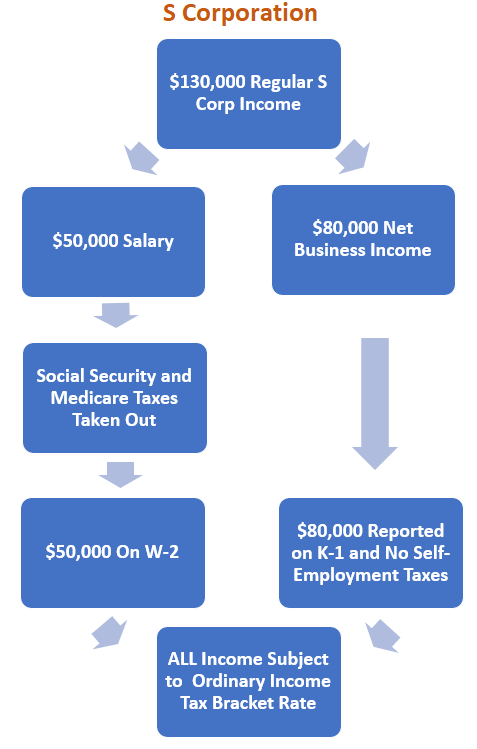

Understand How Small Business Owners Pay Themselves Track Self Employment Tax Liabilities Lend A Hand Accounting Llc

Learn How To Record Owner Investment In Quickbooks Easily

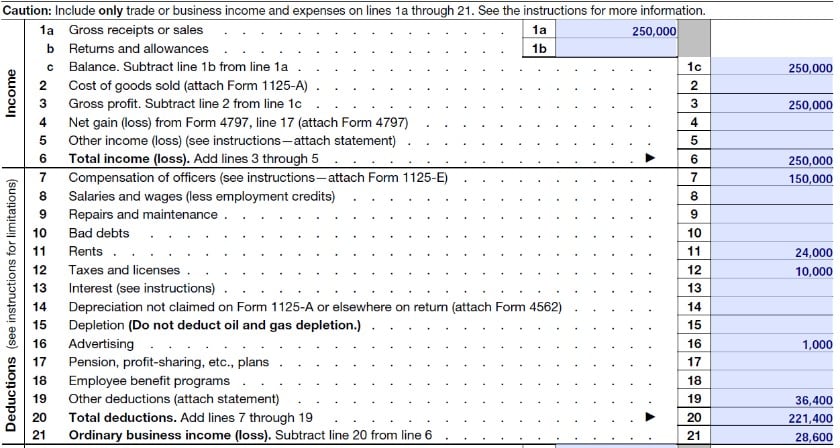

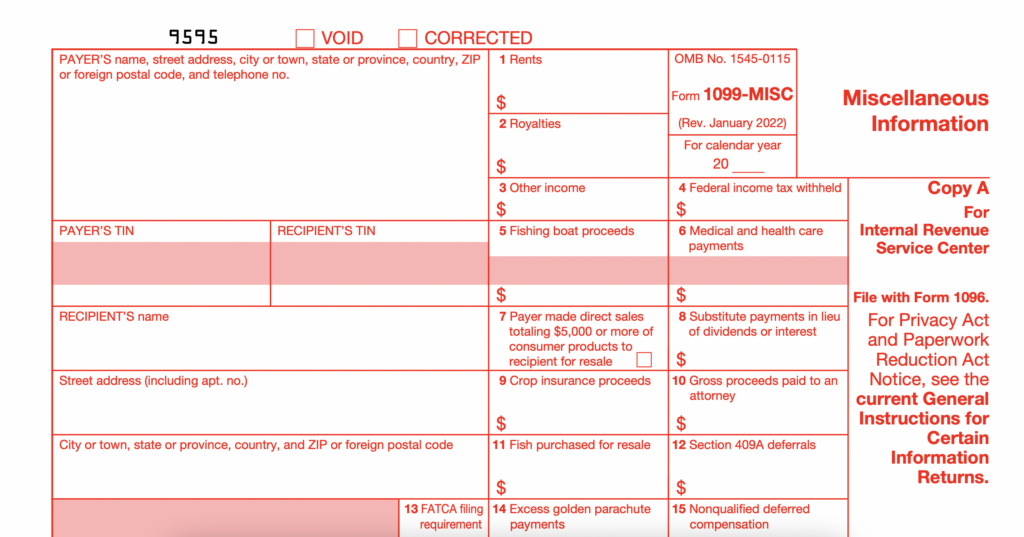

How To Complete Form 1120s Schedule K 1 With Sample

Quick And Dirty Payroll For One Person S Corps Evergreen Small Business

Quickbooks Tip Applying Owner S Time For Job Costing Long For Success Llc

Solved How To Transition Payroll And Entries From S Corp To Llc I Converted To An Llc 12 1 18 Should I Just Purchase A New Qbs Software With Payroll And Keep Old Comp

Learn How To Record Owner Investment In Quickbooks Easily

How To Enter The Owner S Draw In Quickbooks Quora

All About The Owners Draw And Distributions Let S Ledger

C Corp Vs S Corp Partnership Proprietorship And Llc Toptal

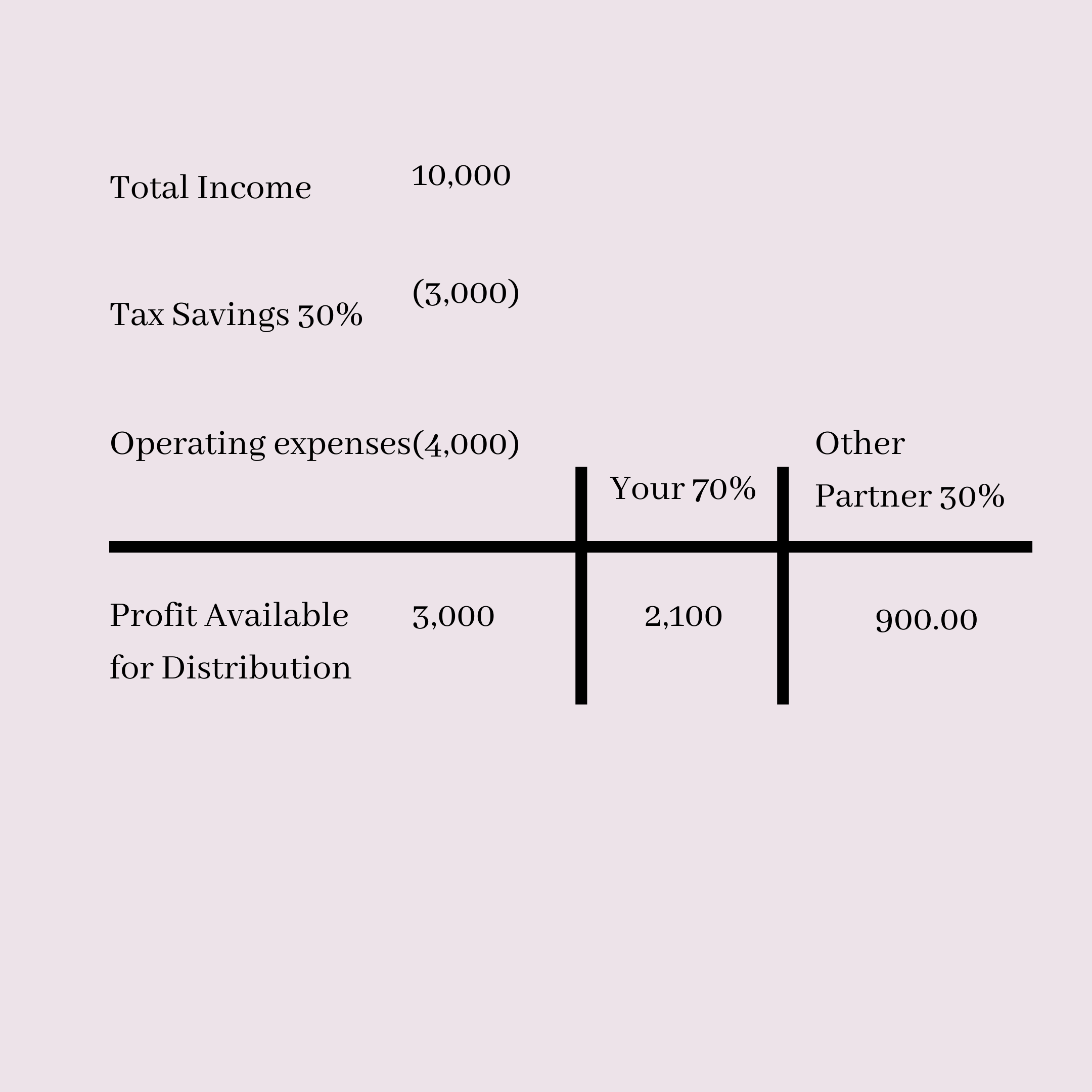

How Do You Pay Yourself As The Owner Of The Business Bookkeeping Network

How To Pay Yourself As A Business Owner In 2022 Tips For All Businesses

I Own An S Corp How Do I Get Paid Clearpath Advisors

All About The Owners Draw And Distributions Let S Ledger

Setting Up Your Quickbooks Online Company Part Six Insightfulaccountant Com